Get Canada's Best Mortgage Rates

Compare Mortgage Rates & Calculate Your Savings Online

Talk to our Trusted Mortgage Brokers & Get Approved for the Best Mortgage Offers from Banks, Credit Unions & Private Lenders for:

New Home Purchase

Mortgage Renewal & Switch

Refinance & Debt Consolidation

Home Equity Line of Credit

Private 1st & 2nd Mortgage

Commercial Mortgage

USA Mortgage

Canada's Best Mortgage Rates

Compare Mortgage Rates & Calculate Your Savings Online

Haggle free Low Mortgage Rates from

Banks, Credit Unions & Private Lenders

Or Get a Free Rate Quote

1800-725-9946

Access Canada's Largest Mortgage Lender Network

Access Canada's Largest Mortgage Lender Network

Trusted Reviews from Real Customers

See why clients love working with us!

Track Your Mortgage from Application & Funding

Top 8 Reasons To Get Your Mortgage With RateShop.ca

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

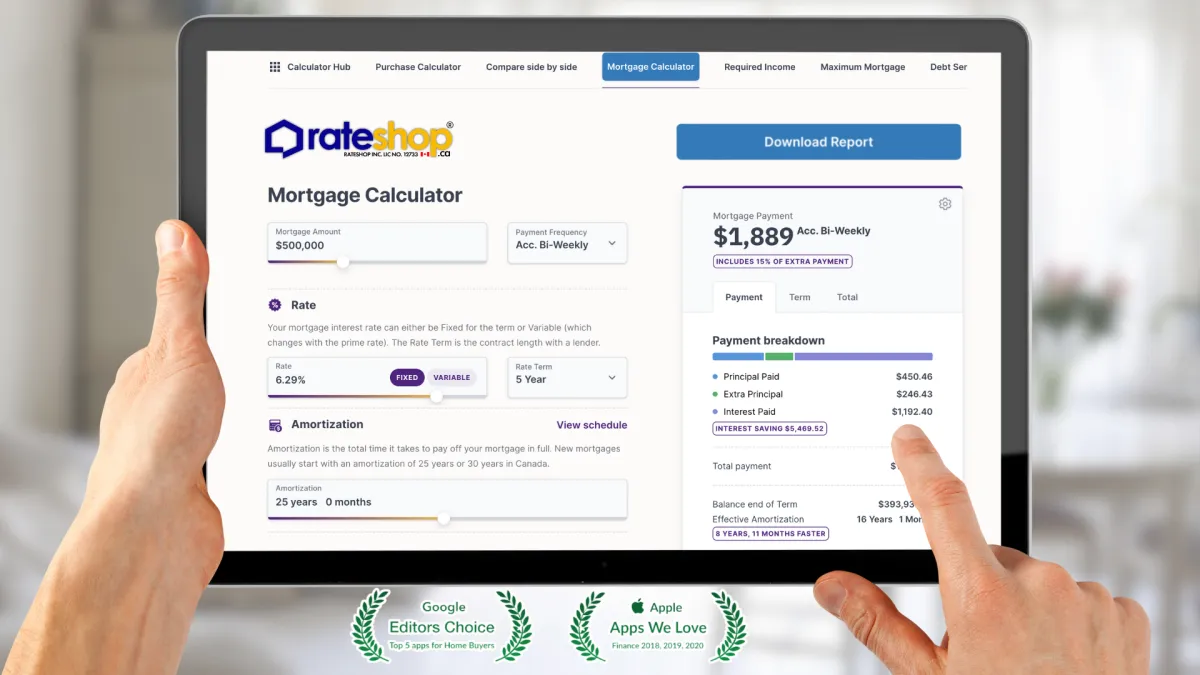

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation. Unleash the power of Artificial Intelligence to help you save on your mortgage!

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner. Our mission is to provide the best mortgage offerings & services on the planet.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costs you more in the future is what our mortgage planning is about. In two to three years into the mortgage term, this becomes very apparent. Customers have called us back telling us how our advice saved them money and educated them to manage finances better.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs, we're fluent in underwriting and we are efficient with approvals. Who & What you know in the industry matters, we understand all bank programs and know where to find you flexibility and rate discounts.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. Breaking news affecting mortgage rates and real estate in Canada. We use our AI technology to compare your rate monthly with available lender offers and find the savings for you.

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation.

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costing you more in the future is what our mortgage planning is about.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs and are efficient with approvals.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. We use AI to compare your rate monthly with available lender offers and find the savings for you.

Canada's Top Independent Mortgage Brokerage

Compare Rates, Lenders and Your Savings

100% Digital Experience, Guaranteed lowest Rates

Easy Mortgage approvals accross Canada & US*

Unbiased Mortgage Advice to help Financial Growth

Streamlined Funding Guaranteed, You're covered!

5 Star Rated Service with Discounted Online Rates

#1 Voted Mortgage Calculators in Canada

Canada's Best

Mortgage Rates

4.09%

Lowest Purchase

3-YR Fixed

Our Mortgage Experts

Dylan James

Mortgage Agent Level 1

Abdoulaye Sow

Mortgage Agent Level 1

Michael Le Chi

Mortgage Agent Level 1

Heith Gharib

Mortgage Agent Level 1

Sara Fresco

Mortgage Agent level 1

Mortgage Learning Center

Home Equity Line of Credit (HELOC) for Canadians: How It Relates to Local Provincial Real Estate Markets

As the Canadian real estate market continues to evolve, homeownership remains a top priority for many. In the face of fluctuating mortgage rates and provincial market conditions, understanding financi... ...more

Mortgage Rates

April 18, 2025•5 min read

CMHC MLI Select Rental Program: How RateShop Delivers Smooth Deal Flow from Discovery to Approval

RateShop simplifies the CMHC MLI Select Rental Program, guiding you from discovery to approval for seamless rental property financing. ...more

Mortgage Rates ,Development & MLI Select Mortgages

April 14, 2025•2 min read

Unlocking the Value of Your Home with a Home Equity Loan

This article explores the basics of home equity loans, their potential benefits, and the top reasons why Canadian homeowners should consider this financial option. ...more

Mortgage Rates

April 11, 2025•4 min read

Second Mortgage and Third Mortgage

Canada’s real estate market is ever-changing, influenced by economic trends, mortgage rates, and provincial market conditions. For homeowners looking to tap into their home equity, second and third mo... ...more

Mortgage Rates

April 04, 2025•3 min read

Mortgage Pre-Approval in Ontario: How It Works & Why You Need It

Get mortgage pre-approval in Ontario to lock in the best rates & boost your homebuying power. Compare lenders today at Rateshop.ca! ...more

Mortgage Rates

April 02, 2025•2 min read

Insider Tips: How to Negotiate the Lowest Mortgage Rate in Any Province

Securing the lowest mortgage rate in Canada can save you thousands of dollars over the life of your loan. ...more

Mortgage Rates

March 31, 2025•2 min read

Mortgage Learning Center

First-Time Homebuyer Guide: Getting the Best Mortgage Rates in Canada

Buying your first home is an exciting milestone, but it can also feel overwhelming, especially when it comes to securing the best mortgage rates. With Canada’s diverse housing market and fluctuating m..

Canada's Mortgage Rates in 2025: Trends and Predictions

As 2025 begins, the Canadian mortgage market continues to draw attention, with homeowners, buyers, and investors eagerly anticipating the trends that will shape the housing landscape. Understanding mo...

How to Compare Mortgage Rates in Canada for the Best Deal

When it comes to buying a home in Canada, securing the best mortgage rate is critical to making your investment affordable and financially sustainable. Mortgage rates directly impact monthly payments .

Understanding Fixed vs. Variable Mortgage Rates in Canada

The decision to choose between fixed and variable mortgage rates is one of the most critical choices Canadian homebuyers face.

As Seen And heard on

Quick Links

Contact Information

6 Indell Lane, Brampton ON L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador. Our Quebec Mortgage Transactions are serviced by Orbis Mortgage Group AMF# 181136.

Copyright 2025. RateShop Canada. All Rights Reserved.