Find The Best Mortgage Rates in Thornhill, Ontario

5-year Fixed Rate

as of

03/11/2026

3.89%

High Ratio Mortgage

5-year Variable Rate

as of

03/11/2026

3.75%

Most Banks Current Prime Rate 4.95%

Get daily updated Canada mortgage lending rates from top lenders in Thornhill, Ontario.

Speak with licensed mortgage brokers to secure the best mortgage rates and lowest mortgage rates in Canada on your terms.

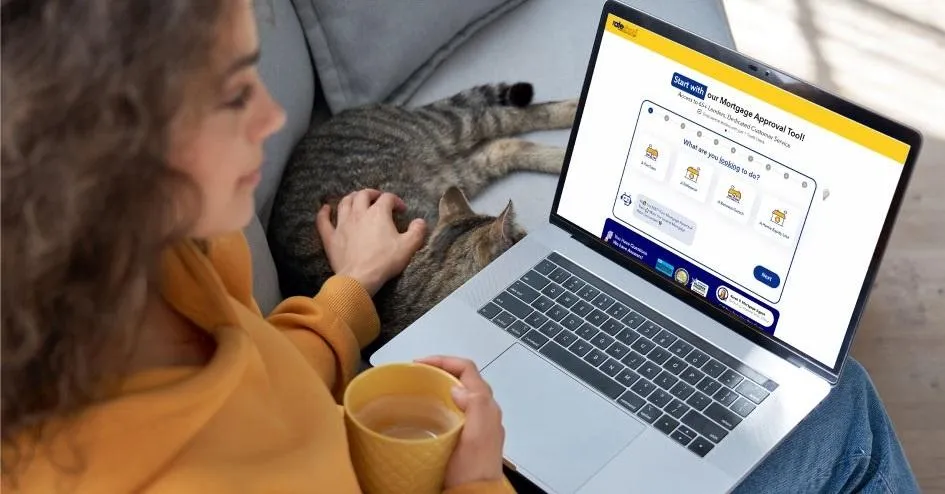

Not Just the Best Mortgage Rate

With over 20 years of experience in the mortgage industry, we’ve been dedicated to helping Canadians save on their mortgage borrowing costs. We’ve seen it all and know what it takes to secure the best deals for you!

Your financial situation is unique—it’s your shelter, your home. That’s why we work tirelessly, negotiating with dozens of lenders across Canada to find you the best mortgage rates tailored to your specific needs.

Our team of experienced mortgage brokers is specially trained to identify opportunities within your income, credit, and assets. We build a strong case to present to our network of trusted lenders, ensuring you get the most competitive home loan rates in Canada.

Whether you’re looking for mortgage brokering services, broker mortgage loans, or simply the best mortgage rates in Canada, we’re here to guide you every step of the way. Let us help you make the most of your mortgage journey!

A Mortgage Solution, for Every Situation

Banks, Credit unions and branchless mortgage lenders compete with your bank's business.

Working with rateshop.ca can get you lower rates than your bank, with the same features like a home equity line of credit or options like pre-payment privileges.

The Only Difference - You Save Thousands!

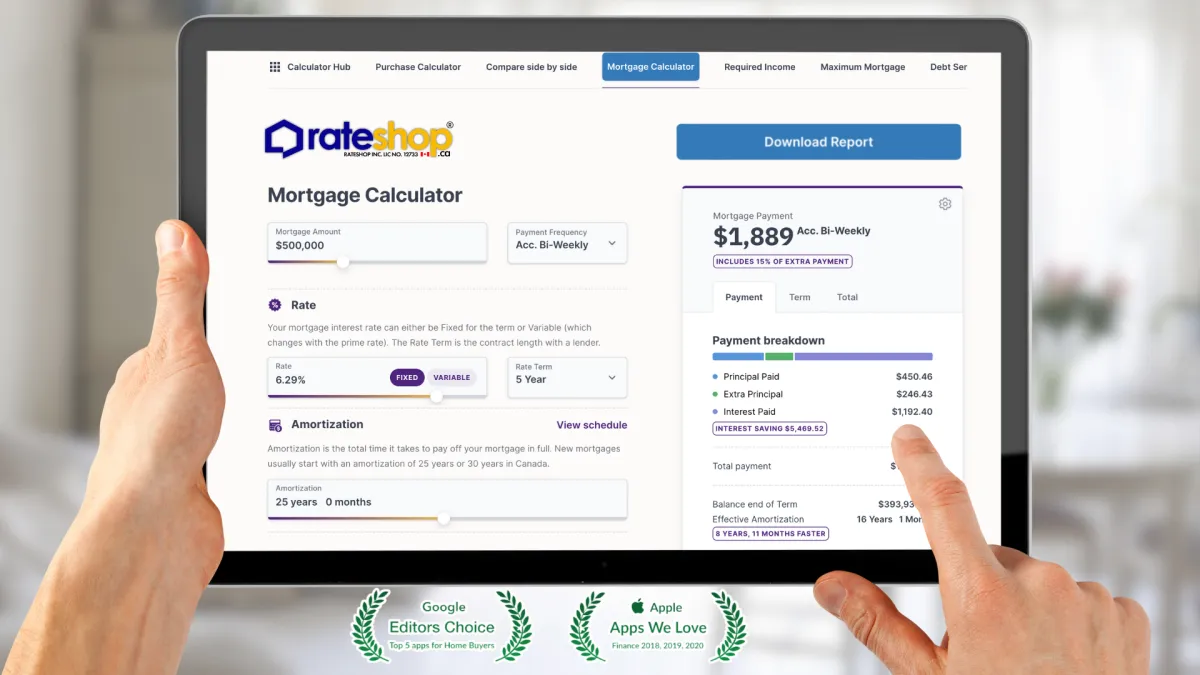

Mortgage Calculator

Easy to use home loan mortgage calculator

Access to Canada's Mortgage Lenders

When you work with RateShop Mortgage, you can access lower mortgage rates than what your bank offers, all while enjoying the same great features like a home equity line of credit or flexible options such as pre-payment privileges.

Our well-connected network of lenders allows us to monitor Canada mortgage lending rates regularly. But we go above and beyond—scouring the internet and collaborating with our lenders to secure better-than-average industry rates. This means deeper discounts and more savings for you.

At RateShop, Canadians gain unfiltered access to the best mortgage rates and home loan rates in Canada. With connections to over 65 mortgage lenders across all provinces, we ensure you get the most competitive mortgage brokering services and broker mortgage loans tailored to your needs.

Whether you’re working with a mortgage broker, exploring mortgage brokerage options, or seeking the expertise of mortgage brokers, RateShop is here to help you find the perfect solution for your home financing goals.

Our Mortgage Brokers in ThornHill

RateShop Mortgage Brokers specialize in delivering tailored mortgage solutions designed to help clients secure the best mortgage rates in Canada. With a deep understanding of local real estate trends, particularly in ThornHill, we leverage our expertise in ThornHill mortgage rates to provide the lowest mortgage rates for a variety of property types and financial situations. Whether you’re purchasing, refinancing, renewing, or exploring a home equity line of credit, we work closely with you to compare mortgage rates and lock in the most advantageous deals. Our in-depth knowledge of local lending programs and incentives ensures you maximize your financial benefits.

By tapping into a vast network of lenders, RateShop mortgage brokers help you save on mortgage costs, often securing better deals than major banks like TD, RBC, BMO, and CIBC. We compare Canada mortgage lending rates from over 65 lenders, including banks, credit unions, and monoline lenders, to find low mortgage rates and the best mortgage deals in Canada. This approach allows us to match your unique financial needs with the most competitive home loan rates in Canada, saving you thousands over the life of your mortgage.

Whether you’re working with a mortgage broker, exploring mortgage brokering services, or seeking brokered mortgage loans, RateShop is committed to helping you achieve your home financing goals. From best mortgage rates ThornHill Canada to Canada low mortgage rates, we’re here to guide you every step of the way.

With 1600+ and Over $1 Billion Mortgages Funded, We are Trusted by Canadians

#1 Voted Mortgage Calculators in Canada

Get Pre-Approved with a mortgage rate hold for 180 days*

Before you Renew with Your Bank, Get a Rate Quote on your Mortgage

Finding the Right Mortgage

Don't lock in just because your neighbour did! Mortgage terms vary from 6 months all the way up to 10 years and you can choose based on your family financial needs. Are you selling soon? Or maybe you want to invest in 2 years. Maybe you want some flexibility, the choice is yours but make it an educated one when you talk to our commission-free mortgage advisors to help you decide on what offers the best mortgage rate and highest savings.

| Fixed Rates | Mortgage Expert Insights |

|---|---|

| 1 Year Fixed Rate |

Great solution for a short-term mortgage needs, renewals can be competitive but rates can go up at maturity without notice. Perfect for new builds to sell after a year or refinance for equity. |

| 2 Years Fixed Rate |

More flexible, a longer duration to support a family need for a couple of years or planning an exit from an existing mortgage without penalties. |

| 3 Years Variable Rate |

3 Year terms can sometimes deliver the best savings, but are typically suggested in a low rate environment, consider a variable too since upon maturity you may get stuck with a higher renewal. |

| 4 Years Fixed Rate |

Banks use this to gain your business, but if you are saving atleast 20-30bps, definitely consider a 4 year term mortgage, compare your savings on a 5 year mortgage term. |

| 5 Years Fixed Rate |

On average, households will upgrade or alter their mortgage about every 5 years, avoiding penalties upon maturity and best rate savings. |

| 5 Years Variable Rate |

Usually recommended in lower rate environments, beat the bank on mortgage penalties and optimize your savings compared to a fixed mortgage offer for the same term. |

Where is the Mortgage Market heading?

History can teach us a lot, check out Canada's mortgage rates history over the past 48 years. Bank of Canada tracks conventional mortgage rates for 3 year and 5 year terms. We can help with understanding the pros & cons to a fixed mortgage rate vs. a variable mortgage rate.

Explore Our Mortgage Options

With recent mortgage rate increases, Canadians are increasingly focused on finding flexible mortgage options that align with their financial goals.

At RateShop, we work closely with our clients to uncover mortgage savings by exploring a variety of offers from multiple lenders. While securing the best mortgage rates in Canada is important, it’s not the only factor in achieving long-term financial stability.

Our experienced mortgage brokers take the time to assess your unique needs, qualifications, and long-term financial goals. Whether you’re looking for home loan rates in Canada, broker mortgage loans, or the best mortgage deals in Canada, we’ll guide you toward the right solution.

By leveraging our expertise in mortgage brokering and access to Canada low mortgage rates, we ensure you get a mortgage that works for you—today and in the future. Let us help you navigate the complexities of mortgage rates and Canada to find the perfect fit for your financial journey!

Learn how to create a monthly income by investing in mortgages

Learn how to create a monthly income by investing in mortgages

About Thornhill, Ontario

Thornhill, located in the Greater Toronto Area (GTA) in Ontario, is a vibrant suburban community known for its rich diversity and family-friendly atmosphere. As of the 2021 census, Thornhill had a population of approximately 114,000 residents, marking a steady increase from the 2016 census, which reported a population of 107,000. Thornhill spans an area of about 11.2 km² and enjoys a high population density, contributing to its dynamic and bustling urban environment. The area offers a mix of residential homes, modern amenities, and excellent transportation links, making it a highly desirable place to live within the GTA.

Thornhill's Real Estate Landscape

Thornhill, Ontario, offers a highly sought-after real estate market, though it comes with a hefty price tag. This suburban community, nestled in the Greater Toronto Area (GTA), has experienced notable fluctuations in its housing market in recent years. As one of the most desirable places to live within the GTA, Thornhill boasts a prime location with easy access to Toronto’s amenities, green spaces, and excellent schools. The average price for a detached home in Thornhill is around $1.5 million, while condo prices start at approximately $500,000. Although the market has seen some cooling since reaching record highs, it remains above the national average, making it a competitive market for both buyers and investors. With a growing population and strong demand for housing, Thornhill continues to attract real estate investors looking for long-term opportunities.

PROPERTY USE

If you are purchasing a property to live in Thornhill as your primary residence, also known as a principal residence, you are eligible for the lowest mortgage rates available. However, if you plan to use the property as a rental investment, certain lenders may offer slightly higher rates. While Thornhill has a large number of primary residences, there has been an increasing demand for rental properties. Mortgage lenders may assess the intended use of your Thornhill property, whether it's for short-term or long-term rental purposes, to determine the appropriate rate.

Our Mortgage Brokers work with a wide range of lenders to secure the best options for investment rental financing, including owner-occupied, mixed-use, or semi-commercial properties. Some properties with an in-law suite can even qualify for both owner-occupied and rental mortgage approval, ensuring you get the best possible mortgage rates. Whether you are purchasing, refinancing, or renewing a mortgage on a Thornhill student rental or multi-plex property that generates income, we can still guarantee the lowest rates.

The Canada Mortgage and Housing Corporation (CMHC) allows the purchase of owner-occupied Thornhill properties with up to 2 units at a 95% loan-to-value (LTV) and up to 4 units at a 90% LTV.

Best Mortgage Banks, Lenders in Thornhill, Ontario

Rateshop.ca works with all banks, credit unions, and monoline lenders across Canada. With access to a wide range of options, our mortgage brokers focus on helping you find the Mortgage Lender in Thornhill that offers the lowest mortgage rate available. We do this by evaluating lenders with the best promotions in Thornhill. Mortgage lenders may have their own internal processes for financing properties in Thornhill.

Lenders like TD Bank, Scotiabank, Meridian Credit Union, DUCA Credit Union, and others may have local branches near you in Thornhill. However, visiting a branch may sometimes result in slightly higher rates. In many cases, lenders such as First National, MCAP, RMG, ICICI, CMLS, Equitable Bank, and others offer similar services online, even if they don’t have a physical branch in Thornhill. Some mortgage lenders may also provide additional offers for local customers in Thornhill as part of their mortgage approval process.

Mortgage Programs Offered in Thornhill

When buying a property in Thornhill, your downpayment will determine your eligibility for insured, insurable, or uninsured mortgage programs.

Insured mortgages in Thornhill start with a minimum 5% downpayment for properties up to $500,000. For properties between $500,000 and $1,000,000, you will need 10% downpayment for the difference above $500,000 in addition to the 5%. The maximum allowed GDS (Gross Debt Service) ratio is 39%, and the maximum allowed TDS (Total Debt Service) ratio is 44%. The default insurance premium is added to the mortgage amount, and the amortization period is capped at 25 years. These mortgages generally offer the lowest rates because of the reduced risk of default for lenders.

Insurable mortgages in Thornhill are available through various banks, credit unions, and monoline lenders. These are known as back-end insured mortgages, where the lender qualifies your purchase under a 25-year amortization and limits the GDS to 39%, and the TDS to 44%. However, for this program, a minimum 20% downpayment is required, and the larger the downpayment, the better the mortgage rate.

Uninsured mortgages in Thornhill allow for amortizations up to 30 years and require a minimum 20% downpayment. These rates are typically higher than insured or insurable mortgages because lenders assume more risk. Refinances are usually considered uninsured, and most lenders will offer home equity lines of credit under this program.

For mortgage renewals in Thornhill, you may qualify for a lower renewal rate if your loan-to-value ratio is low, if you have an active default insurance policy, and if you have not changed the amortization on your mortgage since the purchase.

To find the right mortgage product and secure the lowest rates, contact our experienced mortgage brokers.

Closing Costs in Thornhill, Ontario

For any property purchases in Thornhill, you will need to hire a local Thornhill lawyer to handle the closing process. The lawyer’s role is to prepare all closing documents in accordance with Ontario laws, complete the mortgage registration, and ensure the title is transferred into your name.

The lawyer will perform a title search in the Ontario land registry system, arrange for title insurance, and remit any applicable taxes, such as Ontario Land Transfer Tax. The lawyer is also responsible for liaising with the local municipal office to confirm the status of property taxes in Thornhill. Additionally, the lawyer will address any conditions set by the mortgage lenders and disburse any brokerage commissions related to the transaction.

The combination of legal fees, land transfer taxes, and registration & title insurance fees is known as closing costs. These costs are generally applicable to property purchases, though exceptions exist for refinances, where land transfer taxes may not apply if there are no changes to the title.

Secure Your Dream Home in ThornHill: Find the Best Mortgage Rates and Expert Guidance with RateShop

Impact to My Home Buyers in ThornHill, Canada

For home buyers in ThornHill, fluctuations in interest rates for Canada and Canada mortgage lending rates can significantly impact affordability and purchasing power. Rising rates may reduce the amount you qualify for, making it essential to work with a mortgage broker who can help you navigate these changes. Whether you’re a first-time buyer or looking to upgrade, understanding how mortgage rates and Canada trends affect your budget is crucial.

With home loan rates in Canada on the rise, buyers may need to adjust their expectations or explore alternative options like brokered mortgage loans to secure the best mortgage rates in Canada. A mortgage brokerage can help you compare current mortgage rates in ThornHill to ensure you’re getting the most competitive deal for your situation.

How It Affects Fixed and Variable Rates

The choice between fixed and variable mortgage rates is a critical decision for ThornHill home buyers. Fixed rates provide stability, locking in your interest rate for Canada for a set term, which is ideal for budgeting in a rising rate environment. On the other hand, variable rates fluctuate with the market, potentially offering lower initial rates but with the risk of increases over time.

With Canada low mortgage rates becoming harder to secure, it’s important to weigh the pros and cons of each option. A mortgage broker can help you analyse trends in mortgage rates and Canada to determine whether a fixed or variable rate aligns with your financial goals. For example, if you’re looking for the best mortgage rates Canada 5-year fixed, a broker can guide you toward lenders offering the most competitive terms.

Qualification Process

Qualifying for a mortgage in ThornHill involves several steps, and understanding the process can make it smoother. Lenders will evaluate your income, credit score, debt-to-income ratio, and down payment amount to determine your eligibility. Working with a mortgage broker can simplify this process, as they have access to a wide network of lenders and can help you find the best mortgage deals in Canada.

Getting preapproved for a mortgage is a smart first step. A mortgage loan pre-approval not only gives you a clear idea of your budget but also strengthens your position as a serious buyer. Brokers can also help you explore options like refinancing a mortgage loan or securing a homeowner line of credit if you’re looking to leverage your home’s equity.

Considerations in Finding the Best Mortgage Rate

Finding the best mortgage rates in Canada requires careful consideration of several factors. Here’s what to keep in mind:

Compare Lenders: Don’t settle for the first offer. Use a mortgage brokerage to compare mortgage rates and Canada options from over 65 lenders, including banks, credit unions, and monoline lenders.

Understand Your Needs: Are you looking for the best mortgage rates ThornHill -specific rates? Your location and financial goals will influence the best product for you.

Explore Flexibility: Look for features like pre-payment privileges or the ability to refinance your mortgage if needed.

Work with a Broker: A mortgage broker can help you navigate the complexities of Canada mortgage lending rates and find the lowest Canadian mortgage rate for your situation.

Whether you’re seeking the best mortgage rates in ThornHill , a broker can help you secure a deal that aligns with your long-term financial goals.

Frequently Asked Questions about Mortgages in Thornhill

How to improve your finances with the help of a mortgage?

Consolidate Debt - helps lower your overall interest rate and reduce your monthly payments.

Tax Benefits

Invest in real estate

Use a mortgage to improve your home to increase the value and potentially earn a higher return on investment if you sell it later.

What kind of mortgages are offered in Canada?

Open Mortgage

Closed Mortgage

HELOC (Home Equity Line of Credit)

Reverse Mortgage

Conventional Mortgage

Convertible Mortgage

ARM (Adjustable-Rate Mortgage) or VRM (Variable Rate Mortgage)?

Variable mortgage your mortgage payment amount always remains the same it does not change even if the prime lending rate changes. While adjustable rate mortgage, the amount of your payment changes depending on the prime lending rate.

What mortgage rates are available?

Variable Rates

Fixed Rates

Adjustable Rates

What are today's Best Mortgage Rates?

4.29% - 5 year fixed

5.45% - 5 year variable

You can work with a Rateshop.ca Mortgage Advisors to help you compare options from multiple lenders and find the best mortgage for your needs. It's important to consider not only the interest rate, but also other factors such as the term of the loan, any fees or penalties, the lender's reputation and customer service.

What is a downpayment or Equity?

Downpayment is a payment made by the purchaser when buying a property which means the purchaser's initial investment in purchasing a property. While Equity is the value of your house minus the mortgage amount.

What's included in closing costs?

Closing cost is typically 1.5% of your purchase price. This includes but are not limited to

Land Transfer Tax

Lawyer and Legal Fees

Title Insurance

Mortgage Broker Fee

Property Insurance

What is Mortgage Insurance?

Mortgage insurance is an insurance that protects the mortgage lender or title holder if the borrower fails to make payments, dies, or is otherwise unable to meet the mortgage's terms and conditions.

Everything You Need to Know About Mortgages, Refinancing, and Finding the Best Rates

Portable or Transferable Mortgages

A portable mortgage allows you to transfer your existing mortgage from your current home to a new property while retaining the same terms and interest rates for Canada. This can save you from penalties and help you secure the best mortgage rates in Canada without reapplying.

Standard vs. Collateral Mortgages

Understanding the difference between a standard mortgage and a collateral mortgage is crucial. A standard mortgage uses the purchased property as collateral, while a collateral mortgage includes additional properties, offering flexibility to access more funds. However, collateral mortgages may have higher penalties and are harder to transfer to new lenders.

Steps in a Mortgage Closing

Pre-Qualification: Assess your financial situation to determine how much you can borrow.

Approval: Receive a mortgage offer outlining the terms, including Canada mortgage lending rates.

Conditions & Appraisals: Complete lender conditions and property appraisals.

Solicitor Instructions: Your solicitor receives instructions from the lender.

Signing: Review and sign the mortgage agreement and other legal documents.

Funding: The loan is funded, and the property purchase is complete.

Qualification Criteria

To qualify for a mortgage in Canada, lenders evaluate your income, credit score, and ability to pass the stress test.

Income

Lenders assess your gross debt service (GDS) and total debt service (TDS) ratios, which should not exceed 39% and 44%, respectively. Stable income from salaried jobs is preferred, but self-employed individuals can still qualify with the help of a mortgage broker.

Credit

Your credit score, provided by Equifax or TransUnion, reflects your financial reliability. A higher score can secure you the best mortgage loan rates in Canada.

Stress Test

The mortgage stress test ensures you can afford payments if interest rates for Canada rise. You must qualify at a rate 2% higher than your contract rate or the Bank of Canada’s benchmark rate.

Pitfalls of a Bad Mortgage

Avoid these common pitfalls:

Hidden Fees: Always read the fine print.

High Interest Rates: Compare mortgage rates and Canada to find the best deal.

Prepayment Penalties: Understand the costs of breaking your mortgage early.

Hefty Penalties

Breaking your mortgage early can result in significant penalties, including:

Prepayment Penalties: Charged for paying off your mortgage early.

Discharge Fees: Fees to release your mortgage from the property.

Refinance Restrictions

Refinancing in Canada comes with restrictions:

Maximum LTV: You can borrow up to 80% of your home’s appraised value.

Credit Score: A minimum score of 620 is required.

Income Verification: Lenders will reassess your income.

Appraisal Costs: You’ll need to pay for a property appraisal.

As Seen And heard on

Quick Links

Calculators

Contact Information

6 Indell Lane, Brampton ON

L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador.

Copyright 2026. RateShop Canada. All Rights Reserved.