Find The Best Mortgage Rates in Fort McMurray, Alberta

5-year Fixed Rate

3.89%

High Ratio Mortgage

5-year Variable Rate

3.75%

Most Banks Current Prime Rate 4.95%

Get daily updated Canada mortgage lending rates from top lenders in Fort McMurray, Alberta.

Speak with licensed mortgage brokers to secure the best mortgage rates and lowest mortgage rates in Canada on your terms.

Not Just the Best Mortgage Rate

With over 20 years of experience in the mortgage industry, we’ve been dedicated to helping Canadians save on their mortgage borrowing costs. We’ve seen it all and know what it takes to secure the best deals for you!

Your financial situation is unique—it’s your shelter, your home. That’s why we work tirelessly, negotiating with dozens of lenders across Canada to find you the best mortgage rates tailored to your specific needs.

Our team of experienced mortgage brokers is specially trained to identify opportunities within your income, credit, and assets. We build a strong case to present to our network of trusted lenders, ensuring you get the most competitive home loan rates in Canada.

Whether you’re looking for mortgage brokering services, broker mortgage loans, or simply the best mortgage rates in Canada, we’re here to guide you every step of the way. Let us help you make the most of your mortgage journey!

A Mortgage Solution, for Every Situation

Banks, Credit unions and branchless mortgage lenders compete with your bank's business.

Canadian Mortgage Lenders look for consistent volume business from RateShop brokers . As a Volume Brokerage, we get priority access to Rate Promotions, faster underwriting & approvals, lender exceptions and dedicated personnel are assigned to us to get you a better deal!

The Only Difference - You Save Thousands!

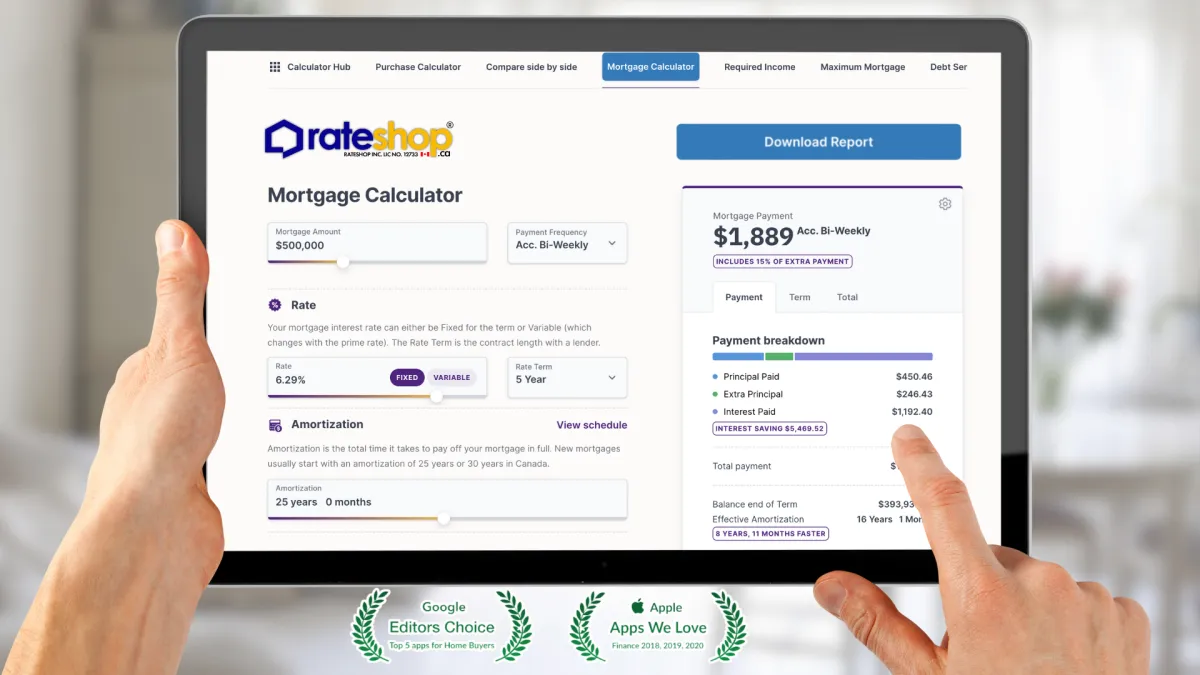

Mortgage Calculator

Easy to use home loan mortgage calculator

Access to Canada's Mortgage Lenders

When you work with RateShop Mortgage, you can access lower mortgage rates than what your bank offers, all while enjoying the same great features like a home equity line of credit or flexible options such as pre-payment privileges.

Our well-connected network of lenders allows us to monitor Canada mortgage lending rates regularly. But we go above and beyond—scouring the internet and collaborating with our lenders to secure better-than-average industry rates. This means deeper discounts and more savings for you.

At RateShop, Canadians gain unfiltered access to the best mortgage rates and home loan rates in Canada. With connections to over 65 mortgage lenders across all provinces, we ensure you get the most competitive mortgage brokering services and broker mortgage loans tailored to your needs.

Whether you’re working with a mortgage broker, exploring mortgage brokerage options, or seeking the expertise of mortgage brokers, RateShop is here to help you find the perfect solution for your home financing goals.

Our Mortgage Brokers in

Fort McMurray

RateShop Mortgage Brokers specialize in delivering tailored mortgage solutions designed to help clients secure the best mortgage rates in Canada. With a deep understanding of local real estate trends, particularly in Fort McMurray, we leverage our expertise in Fort McMurray mortgage rates to provide the lowest mortgage rates for a variety of property types and financial situations. Whether you’re purchasing, refinancing, renewing, or exploring a home equity line of credit, we work closely with you to compare mortgage rates and lock in the most advantageous deals. Our in-depth knowledge of local lending programs and incentives ensures you maximize your financial benefits.

By tapping into a vast network of lenders, RateShop mortgage brokers help you save on mortgage costs, often securing better deals than major banks like TD, RBC, BMO, and CIBC. We compare Canada mortgage lending rates from over 65 lenders, including banks, credit unions, and monoline lenders, to find low mortgage rates and the best mortgage deals in Canada. This approach allows us to match your unique financial needs with the most competitive home loan rates in Canada, saving you thousands over the life of your mortgage.

Whether you’re working with a mortgage broker, exploring mortgage brokering services, or seeking brokered mortgage loans, RateShop is committed to helping you achieve your home financing goals. From best mortgage rates Fort McMurray Canada to Canada low mortgage rates, we’re here to guide you every step of the way.

Get Pre-Approved with a mortgage rate hold for 180 days*

Before you Renew with Your Bank, Get a Rate Quote on your Mortgage

#1 Voted Mortgage Calculators in Canada

Finding the Right Mortgage

Don't lock in just because your neighbor did! Mortgage terms vary from 6 months all the way up to 10 years and you can choose based on your family financial needs. Are you selling soon? Or maybe you want to invest in 2 years. Maybe you want some flexibility, the choice is yours but make it an educated one when you talk to our commission-free mortgage advisors to help you decide on what offers the best mortgage rate and highest savings.

| Fixed Rates | Mortgage Expert Insights |

|---|---|

| 1 Year Fixed Rate |

Great solution for a short-term mortgage needs, renewals can be competitive but rates can go up at maturity without notice. Perfect for new builds to sell after a year or refinance for equity. |

| 2 Years Fixed Rate |

More flexible, a longer duration to support a family need for a couple of years or planning an exit from an existing mortgage without penalties. |

| 3 Years Variable Rate |

3 Year terms can sometimes deliver the best savings, but are typically suggested in a low rate environment, consider a variable too since upon maturity you may get stuck with a higher renewal. |

| 4 Years Fixed Rate |

Banks use this to gain your business, but if you are saving atleast 20-30bps, definitely consider a 4 year term mortgage, compare your savings on a 5 year mortgage term. |

| 5 Years Fixed Rate |

On average, households will upgrade or alter their mortgage about every 5 years, avoiding penalties upon maturity and best rate savings. |

| 5 Years Variable Rate |

Usually recommended in lower rate environments, beat the bank on mortgage penalties and optimize your savings compared to a fixed mortgage offer for the same term. |

Where is the Mortgage Market heading?

History can teach us a lot, check out Canada's mortgage rates history over the past 48 years. Bank of Canada tracks conventional mortgage rates for 3 year and 5 year terms. We can help with understanding the pros & cons to a fixed mortgage rate vs. a variable mortgage rate.

Explore Our Mortgage Options

With recent mortgage rate increases, Canadians are increasingly focused on finding flexible mortgage options that align with their financial goals.

At RateShop, we work closely with our clients to uncover mortgage savings by exploring a variety of offers from multiple lenders. While securing the best mortgage rates in Canada is important, it’s not the only factor in achieving long-term financial stability.

Our experienced mortgage brokers take the time to assess your unique needs, qualifications, and long-term financial goals. Whether you’re looking for home loan rates in Canada, broker mortgage loans, or the best mortgage deals in Canada, we’ll guide you toward the right solution.

By leveraging our expertise in mortgage brokering and access to Canada low mortgage rates, we ensure you get a mortgage that works for you—today and in the future. Let us help you navigate the complexities of mortgage rates and Canada to find the perfect fit for your financial journey!

Learn how to create a monthly income by investing in mortgages

Learn how to create a monthly income by investing in mortgages

About Fort Mcmurray, Alberta

Fort Mcmurray, lands at #49 as a top ranking city in Canada in the province of Alberta and is regarded as a Medium population city. In 2021 the Fort Mcmurray had a count of 68,002 residents which was a jump of change from the previous census of 2016 where the population size was just 67,123. Fort Mcmurray spans over 52.17 km2 and has the #49 rank in population density of 1,303.5/km2.

Fort MacMurray's Real Estate Landscape

Fort McMurray is a city in the Regional Municipality of Wood Buffalo in Alberta, Canada. It is located near the confluence of the Athabasca and Clearwater Rivers, within the heart of the Athabasca Oil Sands. Fort McMurray was originally established as a fur trading post by Peter Pond in 1778, but it wasn't until 1870 that it was officially incorporated as a city. Today, Fort McMurray is known for its large oil sands deposits and as the gateway to the scenic Alberta wilderness. The city has a population of over 61,000 people and is growing rapidly due to the booming oil industry. Real estate prices in Fort McMurray have been rising steadily over the past few years, making it an attractive investment destination for both home buyers and investors. The average price for a detached home in Fort McMurray is currently around $500,000, while condo prices start at around $300,000. Prices are expected to continue to rise in the coming years as more people move to the city to take advantage of the many job opportunities available in the oil industry.

Property use in Fort Mcmurray

If you are buying a property to live in Fort Mcmurray as a primary residence, also known as a principal residence, then your lowest mortgage rates are guaranteed. Depending on the use of your Fort Mcmurray property, certain lenders will price the rate higher if the property is used as a rental investment. Fort Mcmurray has a high concentration of primary residences, however there has been an increase in demand for rental properties, mortgage lenders can look at each Fort Mcmurray property to determine if the property use was intended as short term or long term rental tenant use.

Our Mortgage Brokers work on approvals from various lenders with specialized investment rental mortgage financing options that include owner-occupied, mixed use or semi commercial properties, some properties with an In-law suite can be used towards an owner-occupied and rental mortgage approval and still qualify for the best mortgage rates. You could be purchasing, refinancing or renewing a mortgage on a Fort Mcmurray student rental or a multi-plex property that generates an income and we can still guarantee the lowest mortgage rates.

Canada Mortgage Housing Authority permits the purchase of owner-occupied Fort Mcmurray properties with upto 2 units to a 95% loan-to-value and upto 4 units to a 90% loan-to-value.

See which rates you qualify for.

Best Mortgage Banks, Lenders in Fort Mcmurray, Alberta

Rateshop.ca works with all banks, credit unions and monoline lenders in Canada. With access to so many options, our mortgage broker's focus is on helping you choose a Mortgage Lender in Fort Mcmurray, with the lowest mortgage rate offered. We do so by sifting through lenders with promotions in Fort Mcmurray. Mortgage lenders may follow their own internal process of financing in your Fort Mcmurray.

lenders like TD Bank, Scotiabank, Meridian Credit Union, Duca credit Union and others may have a local branch closest to you in Fort Mcmurray. Sometimes the branch facility can cost you a slightly higher rate. In many cases, lenders like First National, MCAP, RMG, ICICI, CMLS, Equitable Bank and others offer a similar suite of services online, even if they don't have a service location in Fort Mcmurray. Some Mortgage lenders may also combine additional offers with their mortgage approval as a local customer from Fort Mcmurray.

Mortgage Programs Offered in Fort Mcmurray

When buying a property in Fort Mcmurray, your downpayment determines your eligibility under insured, insurable or uninsured programs.

Insured mortgages in Fort Mcmurray start with a minimum of 5% downpayment requirement upto a maxmimum purchase price of $500,000. 10% downpayment is required against the difference between purchase price and $500,000 in addition to the 5% to be eligible for the insured mortgage capped to a purchase price of $1,000,000. The maximum allowed GDS ratio is 39%, and the maximum allowed TDS ratio is 44%. The insurance premium against a default is added to the mortgage amount and amortization is limited to 25 years. These are generally the lowest rates offered by mortgage lenders due to their limited exposure and risk of default.

Insurable mortgages for purchases in Toronto are available through several banks, credit unions and monoline lenders, also known as back-end insured mortgages where the lender will qualify your purchase under a 25 year amortization and limit the GDS ratio to 39%, and the maximum allowed TDS ratio is 44%. However, the downpayment required for this program is a minimum of 20% and the greater the downpayment, better the rate.

For Uninsured Mortgages in Fort Mcmurray, the amortization opens up to 30 years, and requires a minimum of 20% downpayment. These rates are higher in comparison to insured and insurable, mainly due to the mortgage lender's own risk towards your purchase. Refinances are typically treated as uninsured. Most mortgage lenders will only offer home equity line of credit products under this program.

In case of Mortgage Renewals, your property in Fort Mcmurray can qualify for a lower mortgage renewal rate if you have a low loan-to-value, if you have an active default insurance policy and if you have not changed the amortization on your mortgage since purchase.

To qualify for the right product and lowest rate options, contact our knowledgeable mortgage brokers.

Closing Costs in Fort Mcmurray, Alberta

For any property purchases in Fort Mcmurray, you will be required to hire a local Fort Mcmurray lawyer to complete the closing. The solicitor's job is to prepare the closing documents according to Fort Mcmurray laws and complete the mortgage registration on the property, register the title under your ownership.

The lawyer will perform a title search in the Fort Mcmurray of Fort Mcmurray database, arrange for title insurance and remit any applicable taxes, in some cases these are Fort Mcmurray Land Transfer taxes as well as Fort Mcmurray Land Transfer taxes. The lawyer is also responsible for communicating with Fort Mcmurray hall to confirm the status of the property taxes to Fort Mcmurray. The lawyer will also complete the conditions requested by the Mortgage lenders , and disburse any brokerage commissions on the transaction.

A combination of legal fees, land transfer taxes and registration & title insurance fees are known as closing costs, typically applicable to purchases with exceptions incase to refinances where land transfer taxes may not apply if there are no changes to the title.

Secure Your Dream Home in Fort McMurray: Find the Best Mortgage Rates and Expert Guidance with RateShop

Impact to My Home Buyers in Fort McMurray, Canada

For home buyers in Fort McMurray, the interest rate for Canada and Canada mortgage lending rates play a significant role in determining affordability. Fort McMurray’s housing market is unique, heavily influenced by the local oil and gas industry. When home loan rates Canada are low, buyers can secure larger mortgages or enjoy lower monthly payments, making homeownership more accessible. However, when rates rise, even a small increase can strain budgets, especially for first-time buyers or those with variable incomes tied to the energy sector.

The local market has seen fluctuations due to economic conditions, making it essential for buyers to stay informed about mortgage rates and Canada trends. Working with a mortgage broker can help buyers navigate these challenges. Brokers have access to brokered mortgage loans and can find the best mortgage rates in Canada, ensuring buyers get the most value for their investment. Additionally, buyers exploring options like a homeowner line of credit or refinancing a mortgage can benefit from a broker’s expertise.

How It Affects Fixed and Variable Rates

The choice between fixed and variable mortgage rates is a key decision for Fort McMurray home buyers. Fixed rates offer stability, as they remain constant throughout the term, making budgeting easier. Variable rates, on the other hand, fluctuate with the interest rate for Canada, which is influenced by the Bank of Canada’s policies.

In a low-rate environment, such as when Canada low mortgage rates are available, variable rates can save borrowers money over time. However, in a rising rate environment, fixed rates may be more appealing to lock in lower payments. For instance, the best mortgage rates Canada 5-year fixed might be ideal for buyers who prefer predictable payments over the long term.

A mortgage brokerage can provide insights into current trends and help buyers decide which option aligns with their financial goals and risk tolerance. For example, if you’re considering a variable rate, a broker can explain how the posted rate Canada works and how it might affect your payments over time.

Qualification Process

Qualifying for a mortgage in Fort McMurray involves several steps. Lenders assess your credit score, income, debt-to-income ratio, and down payment amount. Getting preapproved for a mortgage is a smart first step, as it gives you a clear idea of your budget and shows sellers you’re a serious buyer.

A mortgage broker can simplify the qualification process by connecting you with pre-approved mortgage lenders who offer competitive mortgage rates best rates. They can also help you understand the posted rate Canada and negotiate better terms. For those with existing homes, refinancing a mortgage loan or accessing a home equity line of credit may be options to consider.

For example, if you’re a first-time buyer, a broker can guide you through the pre-approval for home loan process, ensuring you’re well-prepared to make an offer on your dream home. If you’re an existing homeowner, they can help you explore options like refinancing a house loan or securing a Canada home equity line of credit rates.

Considerations in Finding the Best Mortgage Rate

Finding the best mortgage rates in Canada requires careful research and comparison. Here are key considerations for Fort McMurray home buyers:

Shop Around: Compare mortgage rates and Canada offerings from banks, credit unions, and mortgage brokers. Brokers often have access to brokered mortgage loans with lower rates.

Understand Rate Types: Decide between fixed, variable, or hybrid rates. For example, the best Canadian 5-year mortgage rates might suit long-term planners, while variable rates could benefit those comfortable with risk.

Use Tools: A home mortgage rate calculator can help estimate monthly payments and total interest costs.

Consider Additional Costs: Look beyond the interest rate. Factor in fees, penalties, and features like prepayment options.

Work with a Broker: A mortgage broker can negotiate best mortgage deals in Canada on your behalf, saving you time and money. They can also guide you through refinancing a mortgage or securing a homeowner line of credit.

For example, if you’re looking for the best mortgage rates Ontario Canada or exploring best mortgage rates in BC Canada, a broker can help you find the lowest Canadian mortgage rate available. They can also assist with mortgage preapprovals and pre-approval for home loan applications, ensuring you’re well-prepared to make an offer on your dream home.

Frequently Asked Questions about Mortgages in Fort Mcmurray

How to improve your finances with the help of a mortgage?

Consolidate Debt - helps lower your overall interest rate and reduce your monthly payments.

Tax Benefits

Invest in real estate

Use a mortgage to improve your home to increase the value and potentially earn a higher return on investment if you sell it later.

What kind of mortgages are offered in Canada?

Open Mortgage

Closed Mortgage

HELOC (Home Equity Line of Credit)

Reverse Mortgage

Conventional Mortgage

Convertible Mortgage

ARM (Adjustable-Rate Mortgage) or VRM (Variable Rate Mortgage)?

Variable mortgage your mortgage payment amount always remains the same it does not change even if the prime lending rate changes. While adjustable rate mortgage, the amount of your payment changes depending on the prime lending rate.

What mortgage rates are available?

Variable Rates

Fixed Rates

Adjustable Rates

What are today's Best Mortgage Rates?

4.29% - 5 year fixed

5.45% - 5 year variable

You can work with a Rateshop.ca Mortgage Advisors to help you compare options from multiple lenders and find the best mortgage for your needs. It's important to consider not only the interest rate, but also other factors such as the term of the loan, any fees or penalties, the lender's reputation and customer service.

What is a downpayment or Equity?

Downpayment is a payment made by the purchaser when buying a property which means the purchaser's initial investment in purchasing a property. While Equity is the value of your house minus the mortgage amount.

What's included in closing costs?

Closing cost is typically 1.5% of your purchase price. This includes but are not limited to

Land Transfer Tax

Lawyer and Legal Fees

Title Insurance

Mortgage Broker Fee

Property Insurance

What is Mortgage Insurance?

Mortgage insurance is an insurance that protects the mortgage lender or title holder if the borrower fails to make payments, dies, or is otherwise unable to meet the mortgage's terms and conditions.

Everything You Need to Know About Mortgages, Refinancing, and Finding the Best Rates

Portable or Transferable Mortgages

A portable mortgage allows you to transfer your existing mortgage from your current home to a new property while retaining the same terms and interest rates for Canada. This can save you from penalties and help you secure the best mortgage rates in Canada without reapplying.

Standard vs. Collateral Mortgages

Understanding the difference between a standard mortgage and a collateral mortgage is crucial. A standard mortgage uses the purchased property as collateral, while a collateral mortgage includes additional properties, offering flexibility to access more funds. However, collateral mortgages may have higher penalties and are harder to transfer to new lenders.

Steps in a Mortgage Closing

Pre-Qualification: Assess your financial situation to determine how much you can borrow.

Approval: Receive a mortgage offer outlining the terms, including Canada mortgage lending rates.

Conditions & Appraisals: Complete lender conditions and property appraisals.

Solicitor Instructions: Your solicitor receives instructions from the lender.

Signing: Review and sign the mortgage agreement and other legal documents.

Funding: The loan is funded, and the property purchase is complete.

Qualification Criteria

To qualify for a mortgage in Canada, lenders evaluate your income, credit score, and ability to pass the stress test.

Income

Lenders assess your gross debt service (GDS) and total debt service (TDS) ratios, which should not exceed 39% and 44%, respectively. Stable income from salaried jobs is preferred, but self-employed individuals can still qualify with the help of a mortgage broker.

Credit

Your credit score, provided by Equifax or TransUnion, reflects your financial reliability. A higher score can secure you the best mortgage loan rates in Canada.

Stress Test

The mortgage stress test ensures you can afford payments if interest rates for Canada rise. You must qualify at a rate 2% higher than your contract rate or the Bank of Canada’s benchmark rate.

Pitfalls of a Bad Mortgage

Avoid these common pitfalls:

Hidden Fees: Always read the fine print.

High Interest Rates: Compare mortgage rates and Canada to find the best deal.

Prepayment Penalties: Understand the costs of breaking your mortgage early.

Hefty Penalties

Breaking your mortgage early can result in significant penalties, including:

Prepayment Penalties: Charged for paying off your mortgage early.

Discharge Fees: Fees to release your mortgage from the property.

Refinance Restrictions

Refinancing in Canada comes with restrictions:

Maximum LTV: You can borrow up to 80% of your home’s appraised value.

Credit Score: A minimum score of 620 is required.

Income Verification: Lenders will reassess your income.

Appraisal Costs: You’ll need to pay for a property appraisal.

As Seen And heard on

Quick Links

Contact Information

6 Indell Lane, Brampton ON L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador.

Copyright 2026. RateShop Canada. All Rights Reserved.