Who is RateShop Mortgages

Principal Broker Ali Zaidi has been working in the finance and banking industry since the age of 18. Ali’s 20 years worth lending and real estate experience has allowed him to carve a niche for the products and services offered to clients.

The stern belief in transparency and choice for consumers led to RateShop Mortgages being the first online rate comparison platform to offer upfront mortgage rates based on program and qualification back in 2018. Others followed suit but RateShop continued to evolve into a technology driven brokerage, and with the support of its agents RateShop became the Top Independent Mortgage Brokerage of Canada for 2020 & 2021.

As RateShop invested resources in continuing education for its agents using our Learning System and State of the Art CRM, the persistent realization of wanting to maintain closer relationships with our clients led to teams to further the training offered to agents to leverage technology while improving the financial progress for our clients. We formed teams for closer accountability and now our agents work with you with expert knowledge in each transaction to deliver better and faster approvals.

Director Business Development Michael Squeo is an experienced Mortgage Broker and Real Estate Broker by profession. Michael's experience in mortgages dates back to 2008, running a Centum franchise. Michael Squeo is a partner at RateShop Canada & RateShop US.

Michael started his career with RateShop Mortgage in 2017 and single handedly successfully achieved new milestones for the brokerage by being a pivotal player in building the mortgage agents' team and generating funding volumes. Michael has grown into a capacity to head Lendmax Capital MIC while still involved as a Partner with RateShop Mortgage, he continues to help agents on the RateShop roster and provide consistent nurturing to help the teams' growth.

Manager Business Development Ranjit Nanda, is a veteran in the mortgage industry who has been guiding brokers on how they can progress their careers since 2015 and has helped over 700 Mortgage Brokers in Canada & US. Ranjit having worked in sales for over 15 years now also trains mortgage brokers on sales and customer conversations. Ranjit's perspective to help agents grow their pipeline has been a monumental success in breaking the new jitters, Ranjit has proven his exceptional leadership and mentorship skills and is now dedicated to helping RateShop become the #1 choice of Mortgage Brokers in Canada & US.

Now Ranjit is helping brokers understand what it takes to establish themselves with untold inside information about lenders, compensation and how to get ahead of the competition. Learn whether joining the RateShop Mortgage brand is the right fit for you to create your success story!

RateShop’s Mandate

After having worked for the big banks, it’s easy to recognize the failings of the Canadian mortgage industry that is geared only towards annual targets.

At RateShop we take a different approach to mortgage financing.

We have access to all the lenders, not just a select few. This allows us to maintain a largely flexible product offering.

As a volume brokerage, we negotiate better deals and payouts with lenders. We make more per deal, and offer deeper savings.

Underwriting excellence means, we don’t just submit; we know how to qualify and get the deals approved. We work on the deal to structure it properly, fit it into one of the dozens of programs, so the lowest rates are available every time.

No two mortgage applications are the same, there’s always something unique about your mortgage application so we study how to curb the issues, convince the lenders and address their concerns while negotiating the best rate.

Nowadays, we hear more and more clients holding a commitment in their hands to deals that we’re never meant to be funded. We leave nothing to chance, a well calculated process of underwriting gets us the approvals and the ability to close.

From beginning to end, an assigned licensed mortgage advisor works with you side by side, plus a dedicated underwriter helps you collect the information for your application to best structure the deal, both these interactions are backed by a supervisory position that oversees the correct submission, timelines and best rates from over 65+ lenders. All this activity is also leveraged by the Principal Broker review on every file.

The biggest mistake made by mortgage seeking clients and bank employees or even brokers helping customers is incorrectly structuring the mortgage request not knowing the complete list of market products and their criteria. Our agents and underwriting teams access our resource center to find the latest programs on every lender across Canada, with real time access to relationship development managers to all lending institutions. This knowledge is the support we offer our clients. Confident knowledge in mortgage financing for every income, credit and property situation.

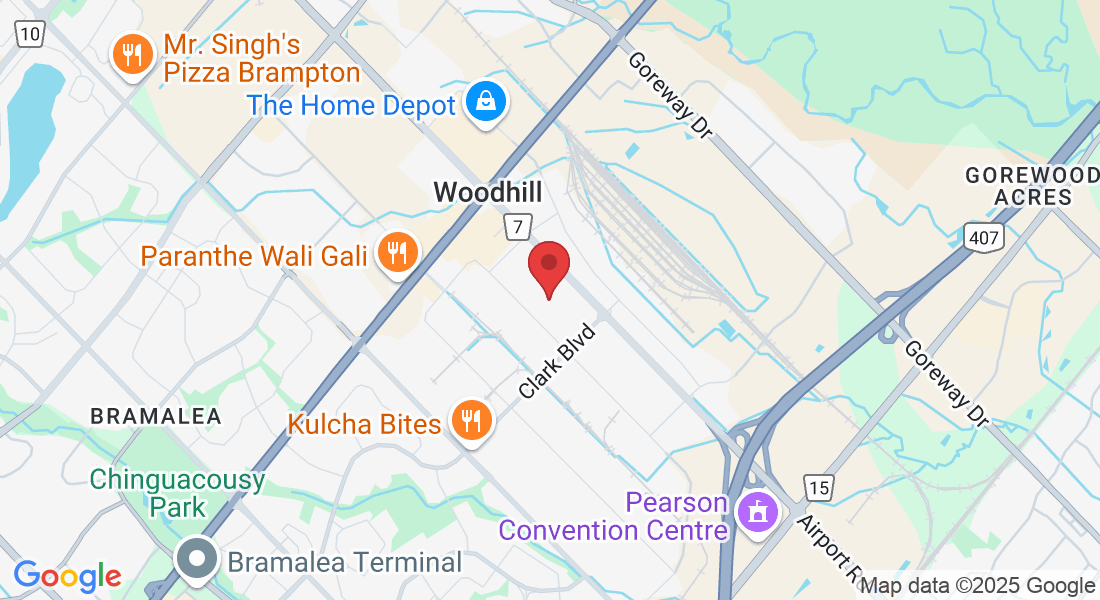

Head Office

6 Indell Ln, Brampton, ON L6T 3Y3, Canada

Customer Service

1228 Main St E, Milton, ON L9T, Canada

British Columbia Office

4529 Melrose Street, Port Albern BC V9Y 1K7, Canada

Alberta Office

10123 99 St NW #1200, Edmonton, AB T5J 3H1, Canada

Saskatchewan Office

855 Arcola Ave Suite 300, Regina SK S4N 0S9, Canada

New Brunswick Office

7 Emerald St, Fredericton, NB E3G 7V3 Canada

Head Office: 6 Indell Ln, Brampton On, L6T3Y3

West Office: 1228 Main St E, Milton On, L9T 8M7

As Seen And heard on

Quick Links

Contact Information

6 Indell Lane, Brampton ON L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador.

Copyright 2026. RateShop Canada. All Rights Reserved.