Get Canada's Best Mortgage Rates -

Online & Hassle-Free

Compare rates, calculate your savings, and get pre-approved with expert guidance – serving all provinces, specializing in Ontario, BC, Alberta & Manitoba.

Talk to our Trusted Mortgage Brokers & Get Approved for the Best Mortgage Offers from Banks, Credit Unions & Private Lenders for:

New Home Purchase

Mortgage Renewal & Switch

Refinance & Debt Consolidation

Home Equity Line of Credit

Private 1st & 2nd Mortgage

Commercial Mortgage

USA Mortgage

Canada's Best Mortgage Rates

Compare Mortgage Rates & Calculate Your Savings Online

Hassle-free Low Mortgage Rates from

Banks, Credit Unions & Private Lenders

Or Get a Free Rate Quote

1800-725-9946

Access Canada's Largest Mortgage Lender Network

Access Canada's Largest Mortgage Lender Network

Trusted Reviews from Real Customers

See why clients love working with us!

Track Your Mortgage from Application & Funding

Top 8 Reasons To Get Your Mortgage With RateShop.ca

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation. Unleash the power of Artificial Intelligence to help you save on your mortgage!

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner. Our mission is to provide the best mortgage offerings & services on the planet.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costs you more in the future is what our mortgage planning is about. In two to three years into the mortgage term, this becomes very apparent. Customers have called us back telling us how our advice saved them money and educated them to manage finances better.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs, we're fluent in underwriting and we are efficient with approvals. Who & What you know in the industry matters, we understand all bank programs and know where to find you flexibility and rate discounts.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. Breaking news affecting mortgage rates and real estate in Canada. We use our AI technology to compare your rate monthly with available lender offers and find the savings for you.

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation.

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costing you more in the future is what our mortgage planning is about.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs and are efficient with approvals.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. We use AI to compare your rate monthly with available lender offers and find the savings for you.

Canada's Top Independent Mortgage Brokerage

Compare Rates, Lenders and Your Savings

100% Digital Experience, Guaranteed lowest Rates

Easy Mortgage approvals accross Canada & US*

Unbiased Mortgage Advice to help Financial Growth

Streamlined Funding Guaranteed, You're covered!

5 Star Rated Service with Discounted Online Rates

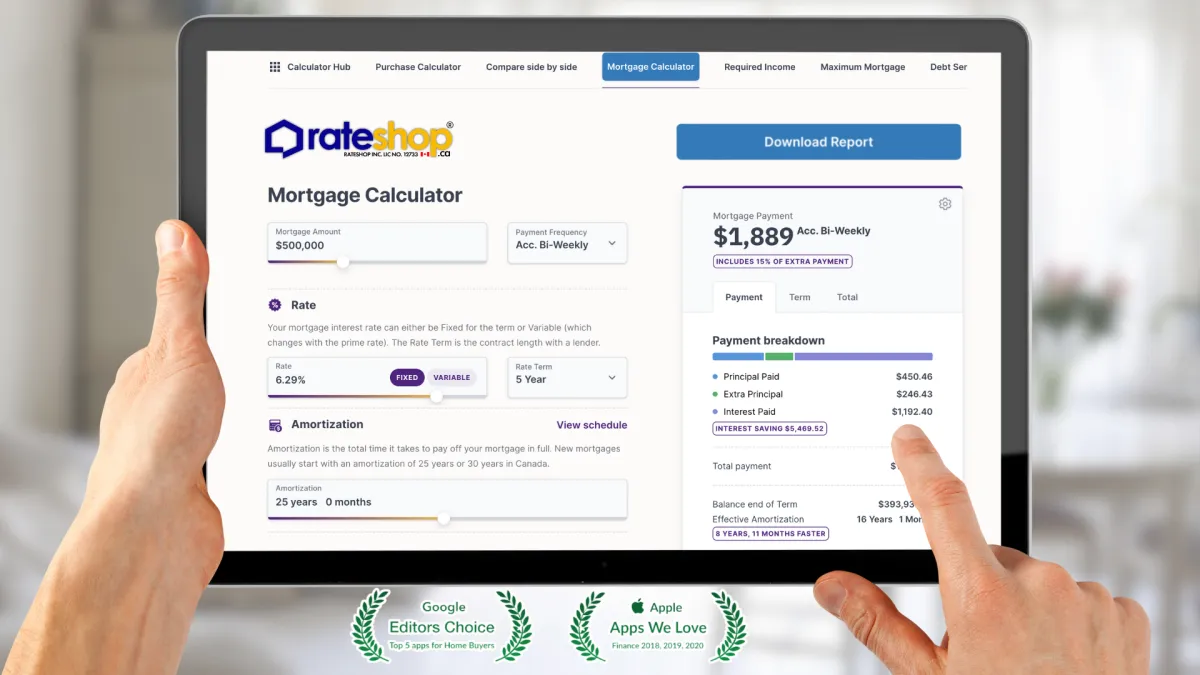

#1 Voted Mortgage Calculators in Canada

Canada's Best

Mortgage Rates

4.04%

Lowest Purchase

3-YR Fixed

Our Mortgage Experts

Dylan James

Mortgage Agent Level 1

Abdoulaye Sow

Mortgage Agent Level 1

Michael Le Chi

Mortgage Agent Level 1

Heith Gharib

Mortgage Agent Level 1

Sara Fresco

Mortgage Agent level 1

Mortgage Learning Center

Spending Can Impact Mortgage Approval

How Holiday Spending Can Impact Mortgage Approval

The holiday season is full of joy — and spending. But for Canadians planning to buy, refinance, or renew a mortgage, holiday spending can quietly hurt mortgage approval chances if not managed carefully. Lenders look closely at your financial behaviour leading up to an application, and December habits can influence decisions well into the new year.

Here’s how holiday spending affects mortgage approval — and how to protect yourself.

1. Credit Card Balances Can Lower Your Credit Score

Holiday shopping often leads to higher credit card balances. Even if you pay on time, high utilization can reduce your credit score.

Why this matters:

Lenders prefer utilization below 30% of your credit limit

Maxed or near-maxed cards signal higher risk

A lower score can mean higher rates or outright decline

A drop of even 20–40 points can change which lenders approve you.

2. Higher Debt Hurts Your Debt-to-Income Ratios

Mortgage approval is heavily based on Gross Debt Service (GDS) and Total Debt Service (TDS) ratios.

Holiday debt increases:

Monthly minimum payments

Total liabilities

TDS ratio — a key approval metric

Even small monthly payments from holiday purchases can push you over lender limits.

3. Buy-Now-Pay-Later Programs Still Count as Debt

Many buyers forget that:

Afterpay

Klarna

Affirm

PayBright

…are still considered liabilities.

Lenders see these as:

Installment debt

Monthly obligations

A sign of short-term cash-flow strain

Multiple BNPL accounts can negatively affect approvals.

4. New Credit Applications Raise Red Flags

Opening new credit during the holidays — even store cards — can trigger:

Credit inquiries

Lower credit scores

Lender concerns about borrowing behaviour

Mortgage underwriters prefer stable credit activity for at least 90 days before approval.

5. Large Purchases Can Affect Bank Statements

Lenders often review:

90 days of bank statements

Down payment sources

Spending consistency

Large unexplained purchases may prompt questions about:

Financial discipline

Available savings

True affordability

This is especially important for first-time buyers.

6. Reduced Savings Can Impact Down Payment Strength

Holiday spending can drain:

Emergency funds

Closing cost reserves

Down payment buffers

Lenders want to see:

Funds left after closing

Financial resilience

Ability to handle unexpected costs

Low remaining savings can weaken an application.

7. Self-Employed Borrowers Face Extra Scrutiny

For self-employed buyers, holiday spending can:

Lower average account balances

Distort cash-flow analysis

Raise questions during underwriting

Consistency is key — especially in the final quarter of the year.

8. How to Protect Your Mortgage Approval During the Holidays

✔ Keep credit utilization below 30%

✔ Avoid new credit applications

✔ Limit buy-now-pay-later plans

✔ Keep emergency and closing funds intact

✔ Pay balances down before applying

✔ Speak to a mortgage broker before major purchases

Even small adjustments can preserve your approval strength.

9. When Holiday Spending Won’t Hurt You

Holiday spending is less impactful if:

Your credit score is already strong (720+)

You maintain low utilization

You have strong income and savings

You’re months away from applying

Timing matters — spending closer to application dates has greater impact.

Final Thoughts

Holiday spending doesn’t mean you can’t enjoy the season — but it does mean being mindful if a mortgage is on your horizon. Credit utilization, debt ratios, and spending patterns all play a role in mortgage approval decisions.

A little planning now can mean better rates, smoother approvals, and fewer surprises in the new year.

If you’d like, I can turn this into a RateShop buyer checklist, holiday finance guide, or Instagram carousel.

Mortgage Learning Center

First-Time Homebuyer Guide: Getting the Best Mortgage Rates in Canada

Buying your first home is an exciting milestone, but it can also feel overwhelming, especially when it comes to securing the best mortgage rates. With Canada’s diverse housing market and fluctuating m..

Canada's Mortgage Rates in 2025: Trends and Predictions

As 2025 begins, the Canadian mortgage market continues to draw attention, with homeowners, buyers, and investors eagerly anticipating the trends that will shape the housing landscape. Understanding mo...

How to Compare Mortgage Rates in Canada for the Best Deal

When it comes to buying a home in Canada, securing the best mortgage rate is critical to making your investment affordable and financially sustainable. Mortgage rates directly impact monthly payments .

Understanding Fixed vs. Variable Mortgage Rates in Canada

The decision to choose between fixed and variable mortgage rates is one of the most critical choices Canadian homebuyers face.

As Seen And heard on

Quick Links

Contact Information

6 Indell Lane, Brampton ON L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador.

Copyright 2025. RateShop Canada. All Rights Reserved.