Get Canada's Best Mortgage Rates -

Online & Hassle-Free

Compare rates, calculate your savings, and get pre-approved with expert guidance – serving all provinces, specializing in Ontario, BC, Alberta & Manitoba.

Talk to our Trusted Mortgage Brokers & Get Approved for the Best Mortgage Offers from Banks, Credit Unions & Private Lenders for:

New Home Purchase

Mortgage Renewal & Switch

Refinance & Debt Consolidation

Home Equity Line of Credit

Private 1st & 2nd Mortgage

Commercial Mortgage

USA Mortgage

Canada's Best Mortgage Rates

Compare Mortgage Rates & Calculate Your Savings Online

Hassle-free Low Mortgage Rates from

Banks, Credit Unions & Private Lenders

Or Get a Free Rate Quote

1800-725-9946

Access Canada's Largest Mortgage Lender Network

Access Canada's Largest Mortgage Lender Network

Trusted Reviews from Real Customers

See why clients love working with us!

Track Your Mortgage from Application & Funding

Top 8 Reasons To Get Your Mortgage With RateShop.ca

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation. Unleash the power of Artificial Intelligence to help you save on your mortgage!

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner. Our mission is to provide the best mortgage offerings & services on the planet.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costs you more in the future is what our mortgage planning is about. In two to three years into the mortgage term, this becomes very apparent. Customers have called us back telling us how our advice saved them money and educated them to manage finances better.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs, we're fluent in underwriting and we are efficient with approvals. Who & What you know in the industry matters, we understand all bank programs and know where to find you flexibility and rate discounts.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. Breaking news affecting mortgage rates and real estate in Canada. We use our AI technology to compare your rate monthly with available lender offers and find the savings for you.

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation.

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costing you more in the future is what our mortgage planning is about.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs and are efficient with approvals.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. We use AI to compare your rate monthly with available lender offers and find the savings for you.

Canada's Top Independent Mortgage Brokerage

Compare Rates, Lenders and Your Savings

100% Digital Experience, Guaranteed lowest Rates

Easy Mortgage approvals accross Canada & US*

Unbiased Mortgage Advice to help Financial Growth

Streamlined Funding Guaranteed, You're covered!

5 Star Rated Service with Discounted Online Rates

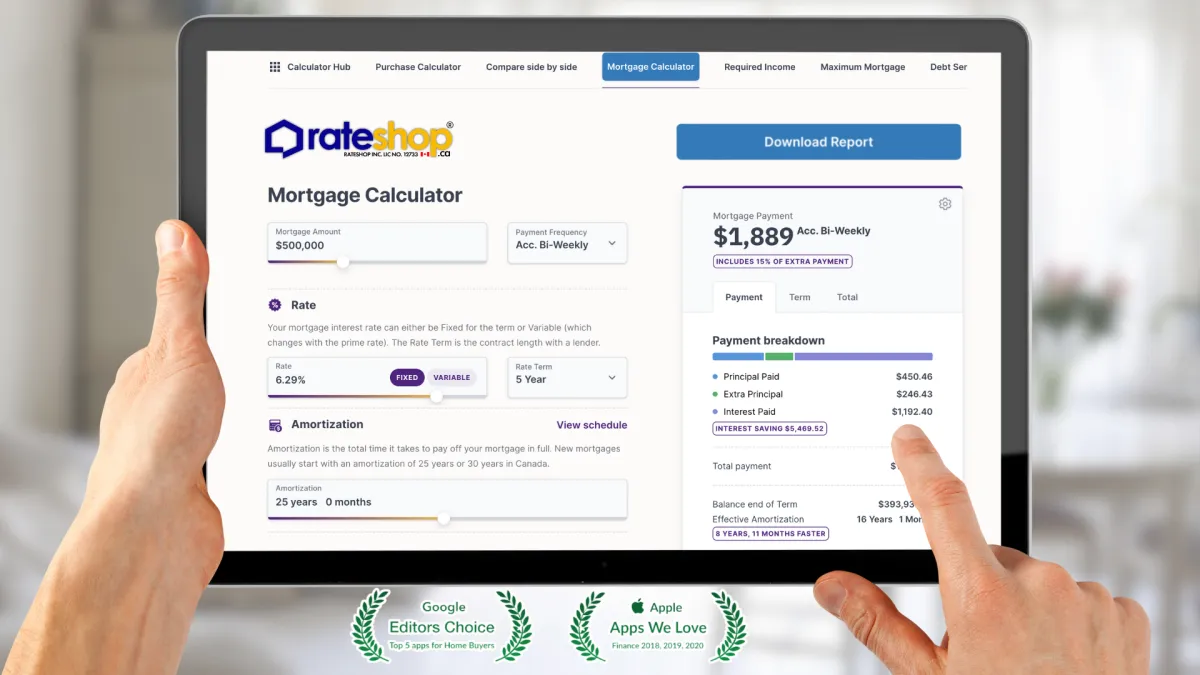

#1 Voted Mortgage Calculators in Canada

Canada's Best

Mortgage Rates

4.04%

Lowest Purchase

3-YR Fixed

Our Mortgage Experts

Dylan James

Mortgage Agent Level 1

Abdoulaye Sow

Mortgage Agent Level 1

Michael Le Chi

Mortgage Agent Level 1

Heith Gharib

Mortgage Agent Level 1

Sara Fresco

Mortgage Agent level 1

Mortgage Learning Center

Second Mortgages in Late 2025: Are They Becoming More Popular?

Second Mortgages in Late 2025: Are They Becoming More Popular?

As Canadian homeowners face rising living costs, lingering debt, and a shifting mortgage landscape, second mortgages have quietly become one of the fastest-growing borrowing tools of late 2025. With traditional refinancing not always possible — especially for homeowners locked into low fixed rates — more Canadians are turning to second mortgages to access equity, consolidate debt, or manage cash flow heading into 2026.

Here’s why second mortgages are gaining traction — and whether they make sense for your situation.

1. Why Second Mortgages Are Growing in Popularity in 2025

Homeowners are increasingly looking for solutions that don’t require breaking their existing mortgage. With many Canadians holding low fixed rates from 2020–2021, refinancing could mean replacing a 1.5–2.5% rate with something in the 4–5% range.

That’s where second mortgages step in.

Key reasons for growing demand:

Avoid breaking low-rate first mortgages

Access equity without refinancing

Consolidate high-interest debt quickly

Easier qualification compared to traditional loans

Fast approvals — helpful before year-end

Second mortgages offer flexibility during a time when households need options.

2. Second Mortgages Are a Popular Tool for Debt Consolidation

Credit cards and unsecured loans have become a major strain for Canadian families.

With second mortgages, homeowners can consolidate:

Credit card balances (20–25%)

Personal loans (9–14%)

Tax debt

High-interest lines of credit

Car loans

Because second mortgage rates are much lower than unsecured borrowing, monthly payments can drop dramatically.

Cash-Flow Example

A homeowner paying $1,200/month in high-interest debt may reduce it to $350–$500/month with a second mortgage — freeing up cash before the holidays.

3. Investors Are Using Second Mortgages to Access Quick Capital

Property investors, especially in Ontario and Alberta, are turning to second mortgages for:

Renovation funds

Down payments for additional properties

Emergency liquidity

Bridge financing

Since approvals are fast and based heavily on equity rather than income alone, second mortgages provide the flexibility investors need in a cooling but opportunity-rich market.

4. Why Homeowners Choose Second Mortgages Over HELOCs

HELOCs are cheaper — so why are second mortgages rising?

Because many homeowners don’t qualify for HELOCs under tighter bank lending rules.

Banks require:

Strong credit

Strong income

Low debt-service ratios

Private and alternative second mortgages offer:

Flexible income requirements

Higher loan-to-value limits

Faster funding

For homeowners facing temporary financial challenges or high debt loads, second mortgages are often the only accessible option.

5. Are Second Mortgage Rates High in Late 2025?

Second mortgage rates are higher than first mortgages but lower than unsecured debt.

Typical Second Mortgage Rates (Late 2025):

7.99%–12.99% depending on credit, equity, and lender

Private lenders may charge fees, but approvals are fast

Compared to 25% credit card interest, second mortgages are still significantly more affordable.

6. Risks Homeowners Should Consider

Second mortgages offer major benefits — but they’re not for everyone.

Risks to understand:

Higher rates than a refinance

Added monthly payment

Potential fees from private lenders

Risk of over-leveraging if used repeatedly

A broker should assess the full financial picture before recommending a second mortgage.

7. When a Second Mortgage Makes the Most Sense

✔ You want to keep your low-rate first mortgage

✔ You need to consolidate high-interest debt

✔ Banks declined your HELOC or refinance

✔ You need fast access to equity

✔ You’re preparing for a 2026 renewal and want to clean up your finances

✔ You need liquidity without restructuring your mortgage

In these scenarios, second mortgages can be a powerful short-term tool.

Final Thoughts

Second mortgages are becoming more popular in late 2025 because they offer flexibility, fast access to equity, and relief from high-interest debt — all without breaking an existing mortgage. While not the cheapest option, they play an essential role for homeowners navigating today’s financial realities.

If you'd like, I can convert this into a RateShop-branded investor guide, IG carousel, or email campaign.

Mortgage Learning Center

First-Time Homebuyer Guide: Getting the Best Mortgage Rates in Canada

Buying your first home is an exciting milestone, but it can also feel overwhelming, especially when it comes to securing the best mortgage rates. With Canada’s diverse housing market and fluctuating m..

Canada's Mortgage Rates in 2025: Trends and Predictions

As 2025 begins, the Canadian mortgage market continues to draw attention, with homeowners, buyers, and investors eagerly anticipating the trends that will shape the housing landscape. Understanding mo...

How to Compare Mortgage Rates in Canada for the Best Deal

When it comes to buying a home in Canada, securing the best mortgage rate is critical to making your investment affordable and financially sustainable. Mortgage rates directly impact monthly payments .

Understanding Fixed vs. Variable Mortgage Rates in Canada

The decision to choose between fixed and variable mortgage rates is one of the most critical choices Canadian homebuyers face.

As Seen And heard on

Quick Links

Contact Information

6 Indell Lane, Brampton ON L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador.

Copyright 2025. RateShop Canada. All Rights Reserved.