Get Canada's Best Mortgage Rates

Compare Mortgage Rates & Calculate Your Savings Online

Talk to our Trusted Mortgage Brokers & Get Approved for the Best Mortgage Offers from Banks, Credit Unions & Private Lenders for:

New Home Purchase

Mortgage Renewal & Switch

Refinance & Debt Consolidation

Home Equity Line of Credit

Private 1st & 2nd Mortgage

Commercial Mortgage

USA Mortgage

Canada's Best Mortgage Rates

Compare Mortgage Rates & Calculate Your Savings Online

Haggle free Low Mortgage Rates from

Banks, Credit Unions & Private Lenders

Or Get a Free Rate Quote

1800-725-9946

Access Canada's Largest Mortgage Lender Network

Access Canada's Largest Mortgage Lender Network

Trusted Reviews from Real Customers

See why clients love working with us!

Track Your Mortgage from Application & Funding

Top 8 Reasons To Get Your Mortgage With RateShop.ca

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation. Unleash the power of Artificial Intelligence to help you save on your mortgage!

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner. Our mission is to provide the best mortgage offerings & services on the planet.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costs you more in the future is what our mortgage planning is about. In two to three years into the mortgage term, this becomes very apparent. Customers have called us back telling us how our advice saved them money and educated them to manage finances better.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs, we're fluent in underwriting and we are efficient with approvals. Who & What you know in the industry matters, we understand all bank programs and know where to find you flexibility and rate discounts.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. Breaking news affecting mortgage rates and real estate in Canada. We use our AI technology to compare your rate monthly with available lender offers and find the savings for you.

Best Mortgage Rates. Period.

We feature rock-bottom rates from several banks, credit unions, and lenders plus many exclusive low rates that aren’t available through other brokers or lenders directly.

Same Day File Review

Our service commitment is, we will never sit idle on a file. The day we have your application & documents, we start our review immediately to analyze all our lender offers and suggest the best one for you.

Largest Choice of Lenders

We offer the most comprehensive list of banks, credit unions, monoline lenders you’ll find in Canada. More choice, better rates, greater flexibility and dozens of purchase, refinance, renewal & home equity programs.

Easy Mortgage Approval

Our application searches from 700+ mortgage offers with various terms, rate types, and lending programs from 65+ mortgage lenders in Canada, that finds your best suited rate for your unique situation.

Award-winning Service

We work relentlessly to improve every aspect of our service, from service to transparent lending solutions. We’re proud and humbled by our clients' and lenders' appreciation to vote us their preferred partner.

Customers Love Us

We always tell our clients, it's not just about the rate! Finding a solution that works for you, instead of costing you more in the future is what our mortgage planning is about.

Mortgage Lenders Love Us

As a volume broker, our lender relations are important. That's what gets us great rates, and this is possible because we know the programs and are efficient with approvals.

Free Mortgage Rate Monitoring

Stay on top of mortgage savings, rate specials, wealth creation tips & investment opportunities. We use AI to compare your rate monthly with available lender offers and find the savings for you.

Canada's Top Independent Mortgage Brokerage

Compare Rates, Lenders and Your Savings

100% Digital Experience, Guaranteed lowest Rates

Easy Mortgage approvals accross Canada & US*

Unbiased Mortgage Advice to help Financial Growth

Streamlined Funding Guaranteed, You're covered!

5 Star Rated Service with Discounted Online Rates

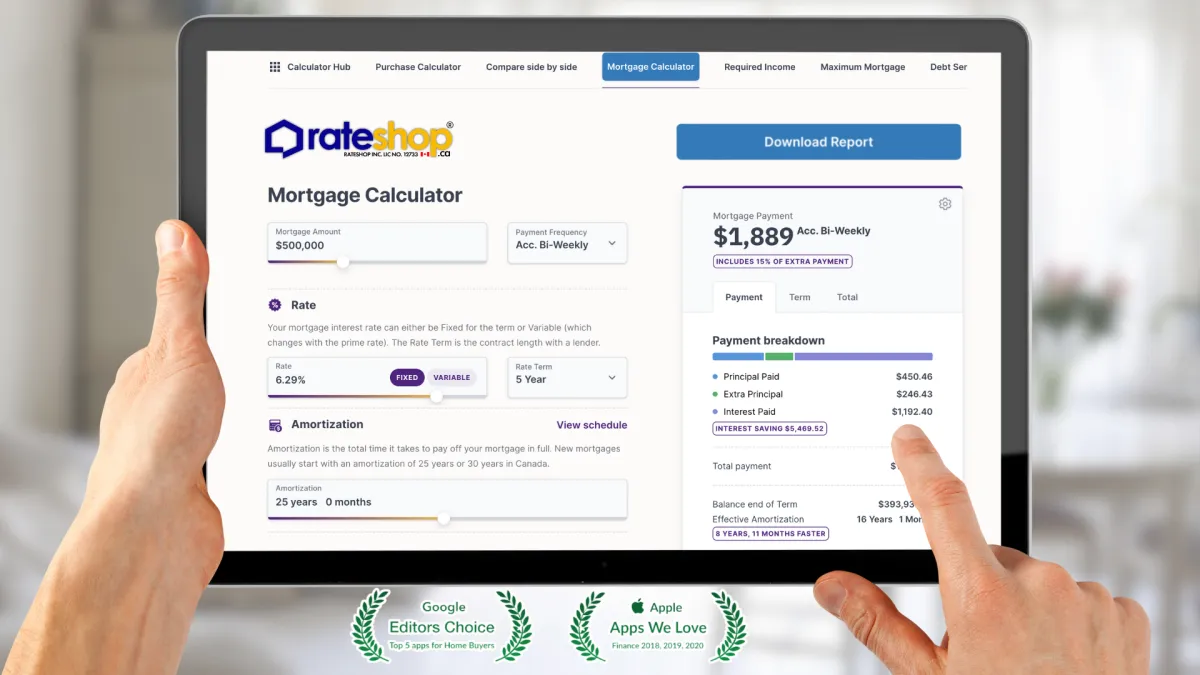

#1 Voted Mortgage Calculators in Canada

Canada's Best

Mortgage Rates

4.09%

Lowest Purchase

3-YR Fixed

Our Mortgage Experts

Dylan James

Mortgage Agent Level 1

Abdoulaye Sow

Mortgage Agent Level 1

Michael Le Chi

Mortgage Agent Level 1

Heith Gharib

Mortgage Agent Level 1

Sara Fresco

Mortgage Agent level 1

Mortgage Learning Center

Mortgage Rates Private Mortgage

The real estate market is a dynamic environment influenced by a variety of factors, with mortgage rates playing a crucial role. For those exploring the Canadian housing market, understanding how mortgage rates and private mortgages work is essential for making informed decisions. Let’s delve into these topics and explore the benefits, risks, and opportunities they present.

Mortgage Rates and Their Impact on Real Estate

What Are Mortgage Rates?

Mortgage rates refer to the interest charged on a home loan. In Canada, these rates are set by lenders but are heavily influenced by the Bank of Canada’s policy rate. Mortgage rates can be fixed, offering consistent payments over the term, or variable, where payments fluctuate based on market conditions.

How Mortgage Rates Shape Real Estate Trends

Mortgage rates significantly impact affordability and demand in the real estate market. For instance:

Lower rates make borrowing more affordable, often increasing demand for homes and driving up prices.

Higher rates can dampen demand, making homes less accessible and potentially cooling overheated markets.

In provinces like Ontario and British Columbia, where real estate prices are high, even small changes in mortgage rates can have significant repercussions. Buyers and investors need to stay informed about rate trends to adapt their strategies accordingly.

Private Mortgages

Private mortgages have gained popularity as an alternative to traditional financing, particularly for individuals who may not qualify for conventional loans. Let’s break down what they are, their advantages and risks, and how to find reliable lenders.

What Are Private Mortgages and How Do They Work in Canada?

A private mortgage is a loan provided by an individual or private organization rather than a traditional financial institution. These lenders include:

Private investors

Mortgage investment corporations (MICs)

Friends or family members

Private mortgages are often short-term solutions, typically ranging from one to three years. They cater to borrowers who face challenges such as:

Poor credit history

Non-traditional income sources

Need for fast approval

The loan terms for private mortgages are usually more flexible, but they often come with higher interest rates compared to traditional mortgages.

Benefits and Risks of Choosing a Private Mortgage in Canada

Benefits

Faster Approval Process: Private lenders typically have less stringent requirements, allowing for quicker loan approvals.

Flexible Terms: These loans can be customized to meet the borrower’s unique needs.

Accessibility: Private mortgages are an option for individuals who may not qualify for traditional financing.

Risks

Higher Interest Rates: Borrowers should be prepared for significantly higher rates compared to bank loans.

Short Loan Terms: Private mortgages often need to be repaid or renewed within a few years.

Potential for Scams: The lack of regulation in the private lending space increases the risk of encountering unreliable lenders.

How to Find Reliable Private Mortgage Lenders in Canada

Finding a trustworthy private lender is crucial for minimizing risks. Here are steps to ensure reliability:

Research and Referrals: Seek recommendations from trusted real estate agents, mortgage brokers, or financial advisors.

Check Credentials: Verify the lender’s licensing and track record.

Understand the Terms: Carefully review the loan agreement, including interest rates, fees, and repayment terms.

Consult Professionals: Engage a lawyer or financial advisor to review the contract and ensure transparency.

Future Trends: Mortgage Rates and Private Mortgages in Canada

As the Bank of Canada continues to adjust its policy rates in response to inflation and economic conditions, mortgage rates are expected to fluctuate. This will likely influence the demand for private mortgages, especially in provinces with competitive real estate markets like Alberta and Quebec.

For prospective buyers, investors, and homeowners, staying informed about mortgage trends and exploring alternative financing options, like private mortgages, can provide a strategic edge in navigating Canada’s real estate landscape.

Mortgage Learning Center

First-Time Homebuyer Guide: Getting the Best Mortgage Rates in Canada

Buying your first home is an exciting milestone, but it can also feel overwhelming, especially when it comes to securing the best mortgage rates. With Canada’s diverse housing market and fluctuating m..

Canada's Mortgage Rates in 2025: Trends and Predictions

As 2025 begins, the Canadian mortgage market continues to draw attention, with homeowners, buyers, and investors eagerly anticipating the trends that will shape the housing landscape. Understanding mo...

How to Compare Mortgage Rates in Canada for the Best Deal

When it comes to buying a home in Canada, securing the best mortgage rate is critical to making your investment affordable and financially sustainable. Mortgage rates directly impact monthly payments .

Understanding Fixed vs. Variable Mortgage Rates in Canada

The decision to choose between fixed and variable mortgage rates is one of the most critical choices Canadian homebuyers face.

As Seen And heard on

Quick Links

Calculators

Contact Information

6 Indell Lane, Brampton ON L6T 3Y3, Canada

Local: 416-827-2626

Toll: 800-725-9946

RateShop Inc. is a Mortgage Brokerage offering lowest mortgage rates to Canadians. We are provincially licensed in the following provinces: Mortgage Brokerage Ontario FSRA #12733, British Columbia BCFSA #MB600776, Alberta RECA #00523056P, Saskatchewan FCAA #00511126, PEI #160622, New Brunswick FCNB #88426, Newfoundland/Labrador. Our Quebec Mortgage Transactions are serviced by Orbis Mortgage Group AMF# 181136.

Copyright 2025. RateShop Canada. All Rights Reserved.