Mortgage Renewal Checklist

H1: Mortgage Renewal Checklist: Shop Your Rate Before Your Term Ends

H2: Introduction – Why Mortgage Renewal is Your Second Chance to Save

When your mortgage term ends, most lenders hope you’ll simply sign their renewal offer without asking questions. The truth? That convenience could cost you thousands of dollars.

Mortgage renewal is your second chance to get the lowest mortgage rate fast—and with tools like RateShop, you can compare mortgage rates across Canada and discover if your bank’s “best offer” is actually far from the best deal.

In this guide, we’ll walk through a step-by-step mortgage renewal checklist to help you prepare early, compare options, and lock in savings.

📸Image Placement #1 (Intro section)

H2: Step 1 – Review Your Current Mortgage Early

H3: Why Timing Matters

Don’t wait until your lender mails you their renewal notice. Start at least 4–6 months before your term ends. This gives you time to compare offers and negotiate.

Many brokers, including RateShop, can secure a 120-day rate hold.

If rates rise, you’re protected.

If rates drop, you can renegotiate before signing.

📊Table Placement #1 – Comparing Renewal Timing

Renewal Approach

Outcome Example

Who Benefits Most

Sign bank’s first offer

Pay higher rate

Busy homeowners who don’t shop

Compare rates early

Access lower rate, save thousands

Savvy homeowners

Use 120-day rate hold with broker

Protection from rising rates

Risk-averse homeowners

H2: Step 2 – Compare Mortgage Rates Canada Wide

Your bank only shows you their own products. Brokers and platforms like RateShop give you access to rates from dozens of lenders.

H3: How to Shop Rates Effectively

Use online tools to get mortgage rate quotes online quickly.

Compare both 5-year fixed mortgage rates and variable mortgage rates today.

Don’t overlook smaller lenders—they often provide the cheapest mortgage rates in Canada.

📸Image Placement #2 (Rate shopping section)

H2: Step 3 – Decide Between Fixed and Variable Rates

H3: 5-Year Fixed Mortgage Rate

Predictable payments for budgeting.

Best for cautious homeowners in rising rate environments.

H3: Variable Mortgage Rates Today

Historically save more over the long term.

Payments fluctuate based on the Bank of Canada’s decisions.

H3: Blended or Hybrid Mortgages

Some Canadians choose to split between fixed and variable, balancing risk with stability.

📸Image Placement #3 (Fixed vs Variable section)

H2: Step 4 – Check If Switching Lenders Makes Sense

Your bank wants to keep you, but loyalty doesn’t always pay off.

H3: Benefits of Switching

Access to lower rates not offered by your current lender.

Opportunity to change terms (e.g., shorten amortization).

Better prepayment privileges.

H3: Costs to Consider

Appraisal fees

Legal/administrative costs

Potential discharge fees

💡 Many lenders will cover switching costs to earn your business. Platforms like RateShop help connect you with those lenders.

📸Image Placement #4 (Switching lenders section)

H2: Step 5 – Use a Mortgage Renewal Best Rate Strategy

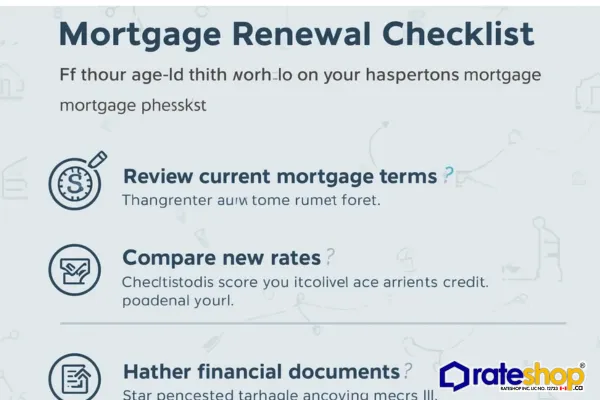

Here’s a simple checklist to follow:

✅ Start comparing rates 120 days before renewal.

✅ Ask your lender for their “best rate” in writing.

✅ Use Mortgage Rates Canada Compare to see if it’s truly competitive.

✅ Consider brokers for the lowest rate mortgage broker near me.

✅ Negotiate or switch lenders if you find a better deal.

📸Image Placement #5 (Checklist section)

H2: Step 6 – Factor in Your Financial Goals

Mortgage renewal is more than just finding a lower rate. Think about your bigger financial picture:

Do you want to pay off your mortgage faster? Choose shorter terms or increase payments.

Do you have bad credit and want to rebuild? Consider working with a bad credit mortgage broker in Canada.

Do you need flexibility as self-employed? Look for fast mortgage pre-approval online with lenders specializing in business owners.

H2: Step 7 – Use a Mortgage Calculator to Estimate Savings

Don’t guess—run the numbers. Tools like a mortgage rate calculator Canada show how even a small rate change impacts your payments.

H2: Key Takeaways

Don’t auto-renew—compare mortgage rates Canada wide.

Use brokers like RateShop for the lowest mortgage rate fast.

Consider your financial goals when deciding fixed vs variable.

Switching lenders can save thousands—especially with covered costs.

Use calculators and strategy checklists to guide your decisions.

H2: Conclusion – Don’t Let Renewal Be a Missed Opportunity

Your mortgage renewal is not just paperwork—it’s an opportunity. By comparing rates, asking tough questions, and using the right tools, you can save thousands over the life of your mortgage.

Don’t settle for your bank’s first offer. Start early, use RateShop to compare, and lock in the best possible deal.